The article was written by: Suzy Wraines

If you hear the word “finance” and cringe with fear, you are not alone. Evaluating numbers in your business is scary. I’m here to reassure you that working with numbers can be simple. You will have your financial milestones set for the next year in three easy steps.

Follow these three steps to reaching your financial goals:

Step One: Create an annual income goal.

Step Two: Set milestone goals.

Step Three: Create a milestone plan.

Creating financial goals can feel like pie in the sky dreaming. When you sit down and visualize your financial goals, they can seem unattainable at first. If it was possible to reach your financial goals, wouldn’t you have done it already? Not necessarily. Creating goals and milestones can be just the thing to get you moving along the right track.

First, you create the end goal and work backward to figure out the “how” through the planning process. Then you break down the big goal into smaller milestones. Having milestones will focus your financial goals for one year.

Let’s go through each step one at a time.

Step One: Create An Annual Income Goal

It’s important to start with a goal you want to achieve. Decide on the annual financial goal you want to achieve. Think BIG when establishing your yearly income goal. Pick an income goal and write it down. The number should be what you hope to reach in a year. Now, this may seem crazy to put a huge number down. It’s okay to feel nervous. Remember, these are numbers you can adjust as you are working throughout the year.

Step one establishes the foundation for steps two and three.

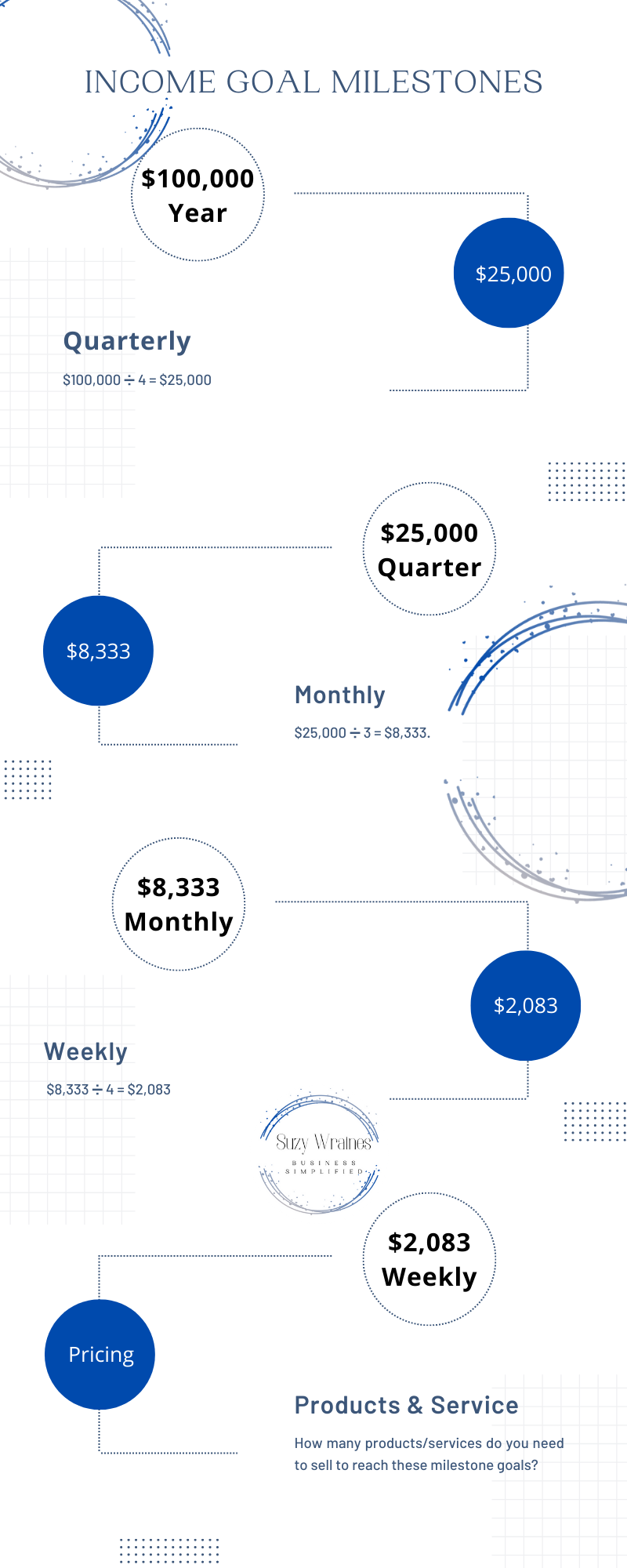

Example: Annual income goal is $100,000

Step Two: Set Milestone Goals

By taking the significant goal you set and breaking it down into smaller goals, you will see just how attainable your big goal is. You determine when you will measure progress (ex., weekly, monthly, quarterly).

Take the example annual goal of $100,000 above. Start by breaking it down by the largest milestone first, quarters. Since there are four quarters in a year, divide $100,000 by four.

Example Quarterly Milestone: $100,000 / 4 = $25,000 per quarter.

Your quarter milestone is $25,000. When you see a smaller income goal, you can be more confident in achieving it. Now let’s break it down even further.

Each quarter has three months. To get a monthly milestone, you will divide $25,000 by three.

Example Monthly Milestone: $25,000 / 3 = $8,333 per month.

That number doesn’t seem so scary! Comparing $100,000 to $8,333 makes it much easier to envision reaching the annual goal.

You can keep breaking this down to weekly. Since there are roughly four weeks in a month. Divide $8,333 by four.

Example Weekly Milestone: $8,333 / 4 = $2,083 per week.

Now that you have an amount and timeline for each income milestone, you can start creating your plan to reach these goals.

Step 3: Create A Milestone Plan

Now it’s time to create a plan for reaching each milestone goal. It should start feeling less overwhelming, having set income goals over time. In this step, you will be mapping out a plan for how you will achieve these goals.

Identify as many income-generating ideas as you can. Identify the products and services, and pricing. Once you have this information, calculate how many you need to sell to reach your milestones.

Service example: Health Coaching Program - price is $2,100

Using the above example, you will need to sell one health coaching program per week to reach your weekly milestone of $2,083.

Product example: Time Management Online Course - price is $500

Using the above example, you will need to sell four online courses per week to reach your weekly milestone goal.

Not every week will be the same. If you don’t reach your income milestone one week, you may double it in a different week and still meet or exceed your monthly goal.

Developing the right products and pricing is vital. I don’t recommend having more than three active offers. But having a few different offers will give your potential customers choices while giving you more flexibility to reach your milestones.

Example using the above products and services:

Monthly milestone goal = $8,333

Sales needed:

13 online courses = $6,500

1 coaching program = $2,100

Total Monthly Sales = $8,600 ($300 over milestone goal)

There are multiple variations to how you can reach your goals through sales. Setting up a solid marketing plan will help you identify how to get to your sales goals. Each product will have a unique marketing plan depending on your ideal client.

These are all things to consider as you create your marketing plan within your business plan.

Conclusion

Using these three simple steps, you will create a business financial plan.

Step One: Create an annual income goal.

Step Two: Set milestone goals.

Step Three: Create a milestone plan.

Now you can relax. Numbers don’t have to be scary. When you feel yourself start to feel overwhelmed, take out a pen and paper and follow the steps. Breaking down the steps will reduce the anxiety that comes with crunching numbers. Know that you can change the numbers at any time.

Now you can relax. Numbers don’t have to be scary. When you feel yourself start to feel overwhelmed, take out a pen and paper and follow the steps. Breaking down the steps will reduce the anxiety that comes with crunching numbers. Know that you can change the numbers at any time. By having smaller milestones, you leave room for adjustments. Hopefully, these steps will take some financial fear out of your business planning. You will have your financial milestones set for the next twelve months when you follow these simple steps.

The steps above are included in the sales and marketing part of your business plan. For those of you who have completed your business plan, you can revisit this section using the steps outlined here.

0 Comments